Digital compliance continues to accelerate, redefining how financial data is recorded, validated, and submitted. As this year winds down, enterprises must stabilize their e-invoicing systems, refine eFPS procedures, and ensure documentation aligns with electronic requirements. This article outlines the digital milestones that should be prioritized before closing the year to secure accuracy, prevent audit disputes, and support a smoother 2026 reporting cycle.

Why 2025 Is a Turning Point

The transition to digital tax administration marks a structural shift in Philippine compliance.

E-invoicing, extended through RR No. 26-2025, is moving from pilot adoption to a wider compliance expectation. At the same time, eFPS continues to enforce strict accuracy and timeliness across filings, raising the bar for internal controls and documentation discipline.

Executives face a landscape where:

Reporting cycles

are faster and more transparent

Documentation

must be complete and digitized

Errors

are traceable and more visible to regulators

Governance

depends on system readiness, not manual interventions

Year-end becomes the pressure point where these systems prove if they can support accurate reporting for 2026.

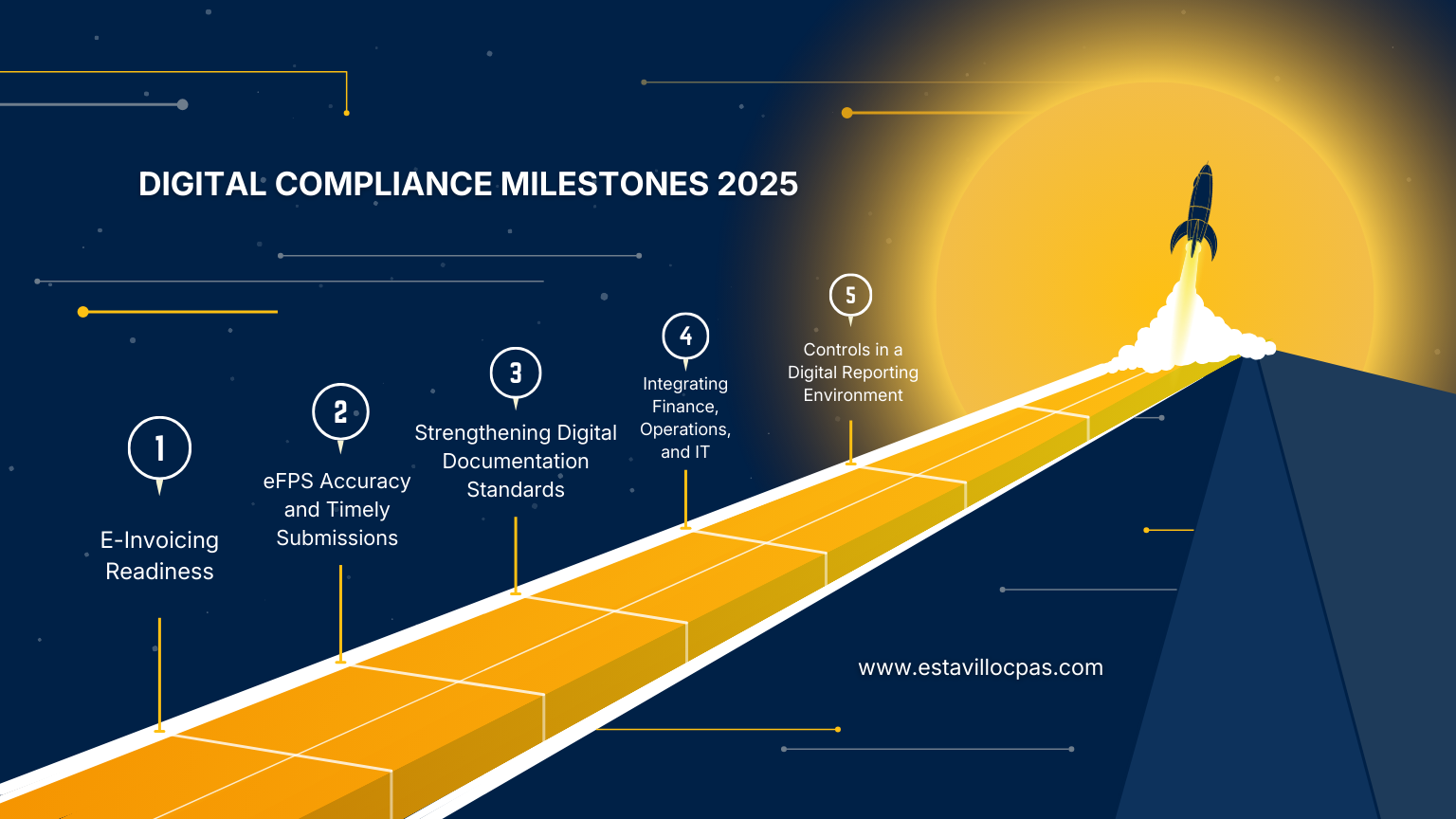

Digital Compliance Priorities

(Estavillo Insight - Recommended Framework)

Pillar 1: E-Invoicing Readiness

Electronic invoicing strengthens audit trails and accelerates reconciliation, but only when systems are fully integrated. RR No. 26-2025 provides more time to comply, yet leaders must treat the extension as a chance to deepen readiness rather than delay action.

Poorly configured systems may cause mismatches between internal books and transmitted invoices, slowing both closing and audits.

Leadership Priorities

Require system testing

and trial transmissions

Align invoice data

with ledger cut-offs and internal controls

Evaluate service-provider capability

and security requirements

Monitor issue logs

to identify recurring mismatches

Pillar 2: eFPS Accuracy and Timely Submissions

eFPS submissions create a digital footprint of the company’s tax profile. Discrepancies between filings and books often become the starting point for BIR inquiries.

To prevent this, the focus must be on upstream accuracy: reconciled balances, updated books, and documentation that matches every declared figure.

Leadership Priorities

Ensure reconciliations precede each filing, not follow them.

Confirm filing calendars are coordinated across departments.

Require a pre-submission review to catch errors early.

Digitize support for taxes claimed or offset.

Pillar 3: Strengthening Digital Documentation Standards

A digital compliance environment demands documentation that is complete, indexed, and accessible.

Scattered files slow audits and increase exposure during inquiries.

Executives must ensure documentation is not only stored but structured.

Leadership Priorities

Implement folder architecture

aligned with accounts

Enforce naming conventions

and digital file completeness

Require backups

and mirrored storage for continuity

Restrict editing rights

to protect file integrity

Pillar 4: Integrating Finance, Operations, and IT

Digital compliance is no longer owned by finance alone.

E-invoicing requires IT support, eFPS affects all departments contributing data, and documentation processes intersect across the organization.

Cross-department misalignment is now a compliance risk.

Leadership Priorities

Schedule monthly alignment

between Finance, IT, and Operations

Harmonize data mapping

across systems

Use a unified compliance calendar

visible organization-wide

Track issues

and enforce time-bound resolutions

Pillar 5: Controls in a Digital Reporting Environment

As systems handle more processes, internal controls must evolve.

Configuration errors, inappropriate user access, and inaccurate system-generated reports can compromise compliance.

Executives must ensure that controls remain strong even as volume and pace increase.

Leadership Priorities

Review user-access rights

and remove outdated accounts

Validate the accuracy

of system-generated reports

Ensure approval workflows

match the latest authority matrix

Document

all system configuration changes

Digital compliance must be treated as a core executive responsibility. E-invoicing and eFPS are not technical shifts but governance upgrades that shape how confidently an organization enters 2026. Establishing alignment, documentation discipline, and digital oversight today ensures faster, cleaner, and more defensible reporting tomorrow.

Stabilize digital compliance systems and align workflows.

Prepare for the full transition to e-invoicing and advanced electronic reporting.

Downloadable PDFs - Governance Toolkit

SEC eFAST Guide (Filing_012025) - Your Guide to Filing of Reports to Avoid Reversion

Provides detailed instructions for preparing and submitting reports through the SEC’s Electronic Filing and Submission Tool (eFAST). The guide outlines formatting rules, required attachments, common submission errors, and the standards for ensuring that filings are accepted without reversion.

Click to downloadBIR Revenue Memorandum Circular No. 81-2025 – Clarifications on the Deductibility of Ordinary and Necessary Business Expenses

Provides guidance on the proper interpretation and application of Section 34(A)(1) of the National Internal Revenue Code concerning ordinary and necessary business expenses.

Click to downloadBIR Revenue Regulations No. 26-2025 – Electronic Invoice Implementation Extension

Provides the guidelines extending the implementation timeline for the electronic invoicing and receipting system under the TRAIN Law. Issued to give affected taxpayers additional time to comply with the e-invoicing requirements.

Click to downloadBIR Revenue Memorandum Order No. 7-2025 - Updated Audit Coverage Thresholds and Procedures

Governs updates to the audit coverage thresholds and guidelines that determine which cases may be subject to audit by the Bureau of Internal Revenue. The issuance outlines prioritization criteria and documentation expectations that support audit enforcement and taxpayer compliance monitoring.

Click to downloadReferences

Bureau of Internal Revenue (BIR) - Referenced for RR No. 26-2025 and overall e-invoicing compliance guidance

Source: https://www.bir.gov.ph

Securities and Exchange Commission (Philippines) - Referenced for digital filing requirements and eFAST expectations.

Source: https://www.sec.gov.ph/

Philippine Institute of Certified Public Accountants (PICPA) - Referenced for professional standards influencing documentation and control expectations.

Source: https://www.picpa.com.ph/

International Federation of Accountants (IFAC) - Referenced for governance and ethical expectations relevant to digital reporting quality.

Source: https://www.ifac.org